Home > The When, How & Why of the AZ Tax Credit

The When, How & Why of the AZ Tax Credit

Welcome to QC Enews Empowerment

We hope you are enjoying the holiday season!

This is a time when many of you, in the spirit of the season, are planning to give to organizations that are important to you. We want to make sure you get credit for you philanthropy – tax credit that is.

In theory, the Arizona Charitable Tax Credit is supposed to be as easy as 1, 2, 3:

- Donate to a qualifying charitable organization.

- Reduce your state tax liability dollar-for-dollar.

- Do good for your community.

But as with everything, it’s all about the details. That’s why we turned to our in-house expert, Quality Connections CFO James Carpenter, for some insights on the Arizona Charitable Tax Credit.

We hope you find this information helpful as you consider your end-of-year donations to organizations that, like Quality Connections, are making a difference in Flagstaff and beyond.

– Armando Bernasconi,

Co-Founder and CEO

Direct Where Your Arizona Tax Dollars Go! Donate and File for the Charitable Tax Credit.

In 1998, the state of Arizona made it easier for residents to support nonprofits. That’s when what is now known as the Arizona Charitable Tax Credit first came into being.

Originally designed to provide basic needs assistance to low-income Arizonans, the tax credit has expanded over the years to include many types of charitable organizations, including Quality Connections.

“What’s great is that donating to a Qualified Charitable Organization doesn’t impact your ability to use other tax credits as well, such as tax credits for supporting schools or for qualifying foster care organizations,” said James Carpenter, CFO of Quality Connections.

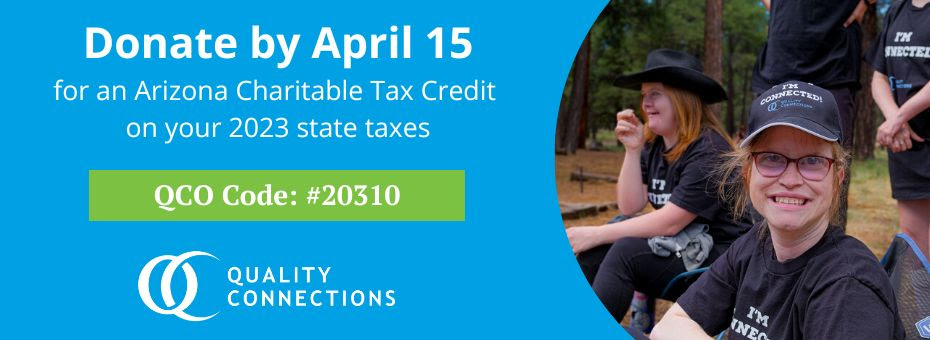

The tax credit allows you to take donations up to $421 for individuals and $841 for couples filing jointly against your 2023 state taxes as long as you donate by April 15, 2024.

Unlike tax deductions, which reduce a person’s taxable income, the Arizona tax credits are dollar-for-dollar reductions in tax liability and thus more valuable. Most of the popular Arizona credits don’t require taxpayers to itemize and they, in essence, allow you to direct where your tax dollars will go.

One of the limitations of the tax credit is that you can only tax credits up to your tax liability. So if you give $421 to Quality Connections, but only owe $300 in state taxes, you can only claim $300 in credits. You can, however, carry over that remaining $121 and apply it to a future tax filing for up to five years.

For Quality Connections, those tax-credit-eligible donations will allow our organization to help more people with physical and developmental disabilities, James said.

“If there’s any reason to give, it’s because there are people out there that we haven’t been able to help yet because we need more staff,” he said. “When you give, you are giving to someone who needs employment services, or adult learning, or in-home help to become more independent.”

Once you make your donation, don’t forget to claim it! Use Arizona Tax Form 321, and remember to include the organization’s QCO number (the QCO for Quality Connections is 20310).

Federal Tax Deduction Deadlines

While the state of Arizona will give you up to April 15 of next year to make your donation and have it count towards your 2023 taxes, the deadlines for making tax-deductible donations for your federal taxes are this month.

- Checks sent via the U.S. Postal Service must be postmarked on or before Saturday, December 30.

- Checks sent via carriers such as FedEx, UPS, and DHL must be received on or before Friday, December 29. The airway bill must also be dated on or before Friday, December 29.

- Wire transfers of cash must be received no later than Friday, December 29. We recommend initiating the transfer no later than Friday, December 22.

- Credit card gifts must be made by phone by 5 pm on Friday, December 29 or online until Sunday, December 31.

- Gifts of appreciated stock should be made by Thursday, December 21 in order to be received by December 29. Please notify us prior to initiating the transfer. Transfers of mutual funds may take additional time, so please consult your investment advisor for details.

Whether it’s by check, credit card or stock, we so appreciate your end-of-year gift and your commitment to Quality Connections!

Stage Buddies & TheatriKids Present: "Rumpelstiltskin - The Game of the Name

Quality Connections is proud to sponsor the upcoming Stage Buddies / TheatriKids production of “Rumpelstiltskin – the Game of the Name” at Theatrikos next month.

All Quality Connections members, employees, families and friends are invited to attend a FREE special performance. Please join us!

Rumpelstiltskin – the Game of the Name

Thursday January 4th at 7PM

Theatrikos – 11 W Cherry Ave

Please RSVP below. Let’s pack the house for this performance!

FYI – Stage Buddies is a free youth theater program that brings together individuals aged 8-21 with special needs alongside previous TheatriKIDS participants and they put on a show together. Many QC Members have performed in Stage Buddies productions over the years.

We need Quality Connections . . . like you!

You can help individuals with disabilities become independent and productive members of our community. There are many way to be a ‘Quality Connection’ and get involved and all of them are important:

Every purchase from QC Office equals employment and job training opportunities for a person with disabilities.

Enable a person with disabilities to become a productive member of our community.

You’ll be doing good. Plus, you’ll get a dollar-for-dollar credit on your AZ state taxes (up to $800!)